Good morning, and welcome to our live coverage of business economics and financial markets today.

Shares in Nvidia are experiens a slight decline by about 7%, despite reporting sales figures that surpassed analyst predictions with revenues climbing over $30 billion (£23bn), an increase exceeding double from the previous year, at 122%. The Silicon Valley chip designer's earnings also outdid projections.

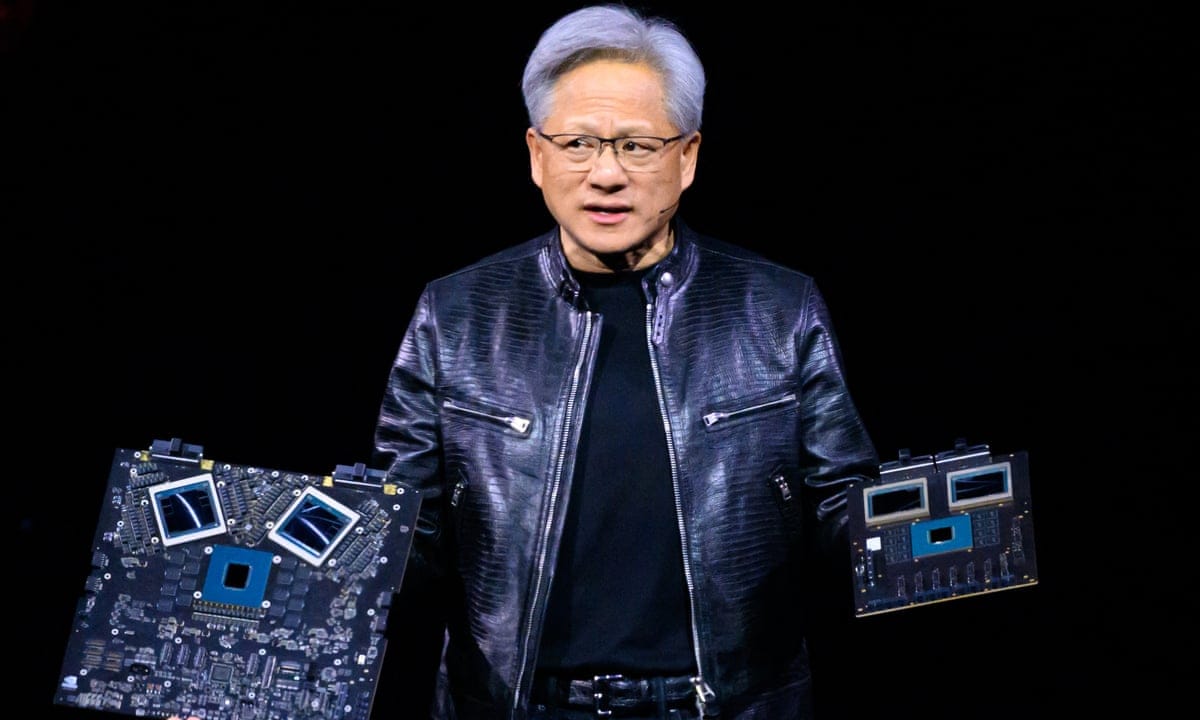

Jensen Huang, Nvidia’s CEO and founder expressed enthusiasm about immense anticipation for their upcoming Blackwell chips — which can house approximately 208 billion transistors to process the computations necessary in training substantial language models— coupled with sustained strong demand for its current lineup. He added:

Nvidia has reached unprecedented revenues as data centers worldwide are actively modernizing their computing infrastructures through enhanced and generative AI techniques.”

The question arises why the company's shares fell after US trading hours, given its positive indicators. One reason may stem from a lack of specific information on production setbacks for Blackwell chips — although Nvidia mentioned these issues were under control by TSMC, Taiwan’s leading semiconductor manufacturer that fabricates their most advanced processors.

Another contributing factor could be the rapid expansion which has made not only meeting but surpassing expectations increasingly difficult for growth-oriented companies like Nvidia—as highlighted by Henry Allen of Deutsche Bank:

Even though they marginally exceeded forecasts, their stock price dropped approximately -7% in aftermarket trade. This was partially because analysts had anticipated an even stronger performance than what the company reported — for instance, while revenue topped estimates slightly, it fell short of some who were looking forward to a more significant leap compared with previous periods; and though Q3's projected revenues did come in modestly higher than predicted average expectations ($32.5 billion vs $31.9 billion), this was still within the spectrum that analyst views account for.”

In parallel, production at British car manufacturing sites has seen a dip by 14.4% as firms shift focus to upcoming models — according to industry body SMMT (Society of Motor Manufacturers and Traders). This drop happened in July while model transitions combined with temporary supply issues led output reductions; among these, the electric Range Rover by Jaguar Land Rover will stand as Britain's first all-electric vehicle to be locally assembled.

Production for this year totaled 482,000 cars — a fall of nearly nine percent compared with last years’ total—with SMMT chief Mike Hawes predicting: “Following significant growth the previous year we anticipated some readjustment in output; volatility is to be expected as our sector restructures for zero emission vehicle production.”

The agenda today includes key events such a European Consumer Confidence survey (August release, consensus at -13 points), speech from Philip Lane on the economic situation by ECB chief economist in Frankfurt and Germany's inflation rate update.

Read next

Ryanair plane had only six minutes of fuel upon Manchester landing, records show

Flight Narrowly Avoids Disaster After Storm Diversion

An inquiry has been launched after a Ryanair flight, struggling against severe winds during storm Amy last week, landed at Manchester Airport with only six minutes’ worth of fuel remaining.

The aircraft had been transporting passengers from Pisa, Italy, to Prestwick, Scotland, on

"Qantas customer data for 5 million exposed as hackers release info post-ransom deadline"

Hackers Leak Personal Data of 5 Million Qantas Customers on Dark Web

A cybercriminal group has released personal records of 5 million Qantas customers on the dark web after the airline did not meet their ransom demand.

The breach is part of a larger global incident affecting over 40 companies,

Investors flee record-high UK stocks as EU set to hike steel tariffs

Investors Withdraw Record Sums from Equity Funds Amid High Market Valuations

Data reveals that investors in the UK have withdrawn an unprecedented amount of money from equity funds over the past three months, driven by concerns over soaring stock market valuations.

According to the latest figures from Calastone, the largest