ByteDance Plans New Share Buyback, Valuing Firm at Over $330 Billion

ByteDance, the parent company of short-video platform TikTok, is preparing to introduce a new share buyback program for employees, valuing the Chinese tech firm at more than $330 billion, according to three individuals familiar with the matter. The move follows steady growth in revenue.

Under the buyback, employees will be offered $200.41 per share, up from $189.90 in a similar program six months ago, which had valued the company at approximately $315 billion. The latest repurchase is expected to begin in the autumn.

The higher valuation comes as ByteDance strengthens its position as the top-earning social media company globally. Its second-quarter revenue reportedly increased by 25% compared to the previous year, reaching around $48 billion. Much of this revenue originates from China, though the company continues to face political pressure to sell its U.S. operations.

The updated valuation and second-quarter revenue figures had not been disclosed previously. Sources asked not to be identified as they were not permitted to discuss the matter publicly. ByteDance did not immediately comment when contacted.

Earlier this year, ByteDance’s first-quarter revenue exceeded $43 billion, surpassing Meta, owner of Facebook and Instagram, which reported $42.3 billion in sales for the same period. Both companies maintained revenue growth above 20% in the second quarter.

ByteDance conducts buybacks for employees twice a year, allowing staff at the privately held firm to sell portions of their shares. The program highlights the company’s financial resilience amid expanding operations in China and abroad.

Regular share repurchases have become a common strategy for late-stage private firms to offer liquidity to employees without pursuing a public listing. While companies like SpaceX and OpenAI rely on investor funds for such programs, ByteDance finances its buybacks independently, reflecting strong financial health.

The company is also recognized as a key player in China’s artificial intelligence sector, investing heavily in Nvidia chips, AI infrastructure, and model development.

TikTok Divestment Challenges

Despite surpassing Meta in revenue this year, ByteDance’s valuation remains less than one-fifth of Meta’s $1.9 trillion market cap. Analysts attribute this gap largely to U.S. political and regulatory risks.

In the U.S., lawmakers have pressed ByteDance over national security concerns due to its Chinese ownership. Last year, Congress passed legislation requiring the company to divest TikTok’s U.S. assets by January 19, 2025, or face a nationwide ban. The app currently has 170 million American users.

Donald Trump had previously granted TikTok extensions on divestment deadlines, most recently postponing the deadline to September 17.

Read next

"Tesla's European sales drop 40% while BYD registrations surge over threefold"

Tesla Sales Decline in Europe as BYD Gains Ground

Tesla saw a 40% drop in European sales in July compared to the same period last year, as the company faces growing competition from Chinese automaker BYD.

According to data from the European Automobile Manufacturers’ Association (ACEA), 8,837 Tesla vehicles

"Musk's Doge ally seizes control of leading US MDMA firm"

Months before Antonio Gracias became involved in scaling back federal operations, he was at Burning Man.

Amid Nevada's dusty landscape, Gracias—a billionaire investor with close ties to Elon Musk—attended Nova Heaven, a sunrise event honoring victims of the October 7 attack. There, he found himself near

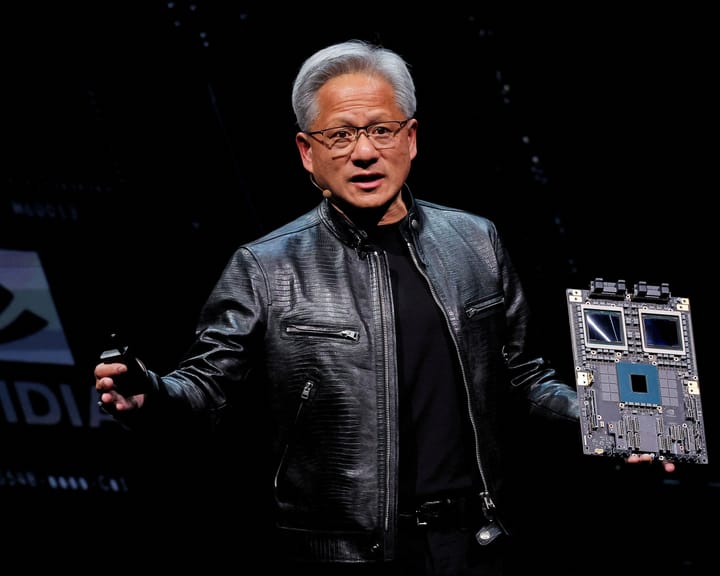

"Nvidia to reveal Q2 earnings amid AI demand surge"

Nvidia to Announce Q2 Results Amid AI Market Uncertainty

Nvidia is preparing to release its second-quarter earnings on Wednesday, marking a key moment for investor sentiment after a recent decline in AI-related stocks.

The chipmaker’s financial performance will be closely watched, given its influence on the broader AI sector