Today’s Highlights

- London residents purchasing fewer properties outside the capital, lowest share since 2013

- Shrinking product sizes affect popular confectionery brands

- UK regulator faces criticism over alleged rule violations in its promotional activities

- New trade secretary Peter Kyle to visit China for discussions this week

- Jaguar Land Rover operations may face delays until October following cyber incident

- Travel disruptions expected on London’s underground as strike action grows

- Roman Abramovich investigated in Jersey over alleged financial misconduct

- Former minister praises Trump’s approach in push for stronger tech ties between UK and US

Key Developments

China’s export expansion slowed sharply in August, reaching the weakest pace in half a year, as shipments to the U.S. declined amid ongoing trade disputes. Official data showed exports rose by 4.4% compared to the previous year, falling short of forecasts and below July’s 7.2% growth. Imports also weakened, increasing by 1.3%, down from 4.1% a month earlier.

Trade with the U.S. dropped significantly, with exports decreasing by 33%, while sales to Southeast Asian markets grew by 22.5%. Officials have been urging manufacturers to diversify trade partners due to uncertainty over U.S. policies. President Trump recently postponed imposing new tariffs on Chinese goods, extending the previous agreement by 90 days just before its expiration.

Earlier threats included potential tariffs up to 245% from the U.S., with China warning of retaliatory duties as high as 125%. Current levies on Chinese goods stand at 10% with an additional 20% in response to trade disputes, with some products facing even higher charges.

China’s trade surplus expanded slightly to $102.3 billion in August from $98.2 billion in July, though it remained lower than June’s $114.8 billion. Analysts are watching for potential economic stimulus measures to boost domestic demand in the coming months.

Elsewhere, German export figures unexpectedly declined in July, dropping 0.6% from June’s level, contrary to expectations of slight growth. Imports were also lower, falling by 0.1%. The trade surplus narrowed to €14.7 billion from €15.4 billion in June. However, industrial output in Germany rebounded, rising 1.3%.

Oil prices increased as OPEC+, which includes Russia, decided to reduce planned production increases starting in October amid concerns over demand. Geopolitical risks also rose after Russia’s military actions in Ukraine. Brent crude climbed 1.5% to $66.45 per barrel. The producer group’s planned supply adjustment was set at 137,000 barrels per day, significantly smaller than earlier projections.

Read next

"Nations weigh halting Russian oil and gas purchases as Trump sanctions take quick effect"

Donald Trump’s efforts to mediate peace in Ukraine may hinge on one critical issue: can the U.S. leader persuade nations to reduce their reliance on Russia’s energy exports?

Recently, Trump introduced sanctions against two of Russia’s biggest oil firms, Rosneft and Lukoil, aiming to weaken Moscow’

"Risks of centrist economics in a divided world"

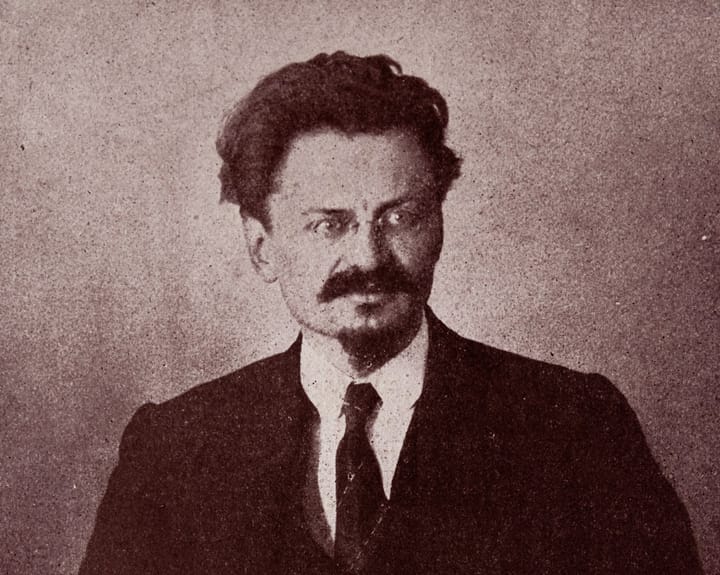

Navigating the economic landscape as a centrist thinker is challenging in today’s politically charged environment, where every viewpoint is quickly categorized into rigid ideological positions. A sentiment often linked to Leon Trotsky applies here—centrist economists may avoid conflict, but conflict finds them regardless.

Take, for example, my 2016

"Bloomsbury head suggests AI aids writers in overcoming block"

Artificial intelligence may assist authors in overcoming creative hurdles, according to the head of the publishing company Bloomsbury.

Nigel Newton, founder and chief executive of the firm behind the *Harry Potter* series, suggested that while AI could support various creative fields, it would not replace well-known writers entirely.

"AI