The government has maintained an appropriate approach to taxation, Rachel Reeves stated after a former Labour finance official suggested she explore the possibility of a wealth tax.

Reeves noted that taxes had already been raised on the wealthiest through increased charges on private jets, additional properties, and higher capital gains taxes.

Speaking in Scotland, she said: “Last year’s budget removed non-domicile tax status, ensuring those who live in Britain contribute fairly. We’ve struck the right balance in taxing those with the greatest means, but any future changes will follow standard budget procedures.”

Her comments followed remarks by Anneliese Dodds, who left her role as a Foreign Office minister this year. Dodds urged policymakers to examine proposals for a one-time levy on millionaire households.

In an interview with CuriosityNews, Dodds referenced economist Arun Advani’s work. Advani’s 2020 report proposed a 1% charge on household wealth exceeding £1 million as an alternative to taxing workers and consumers.

When asked about the idea, Reeves responded: “This government’s top priority is economic growth. Taxation must be balanced to attract investment and jobs.”

Government officials noted there was no current proposal for a wealth tax and emphasized past failures of such policies elsewhere. “Experts agree it doesn’t work,” one source said.

Dodds, speaking on a political podcast, argued the Treasury should review the wealth tax commission’s findings, which detailed how such a policy could function in the UK.

Ministers have disagreed on the issue. Crime and Policing Minister Diana Johnson said it was crucial to examine all evidence on what measures would be effective.

Conversely, Business Secretary Jonathan Reynolds dismissed a wealth tax as unrealistic, urging colleagues to focus on practical solutions. He noted that few countries implement such taxes successfully, citing Switzerland’s system as an exception.

Read next

"Democrats blame Trump tariffs for job losses, rising prices, and market decline – live updates"

'Costing Jobs and Raising Prices': Democrats Criticize Trump Over Tariffs and Weak Employment Data

Democratic leaders have condemned former President Trump’s tariff policies and federal budget reductions after a disappointing jobs report showed 258,000 fewer jobs were added in May and June than initially estimated.

Senate

UK immigration rhetoric fueled backlash against antiracism, study finds

Study Finds "Hostile Language" in Media and Parliament Often Targets People of Colour

A pattern of “hostile language” in news reports and UK parliamentary debates is more likely to describe people of colour as immigrants or with less sympathy, researchers have found.

The Runnymede Trust, a race equality

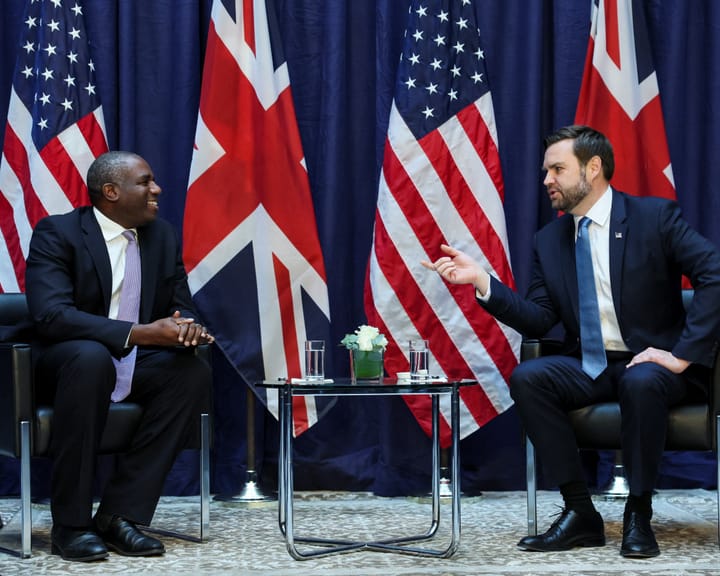

"Lammy and Vance bond over tough upbringings and Diet Coke"

David Lammy Reflects on Friendship with US Vice-President and Personal Struggles

David Lammy has spoken about his friendship with US Vice-President JD Vance, noting they share a bond over their challenging upbringings.

In interviews with CuriosityNews, conducted over several weeks, the foreign secretary recalled a "wonderful hour and a