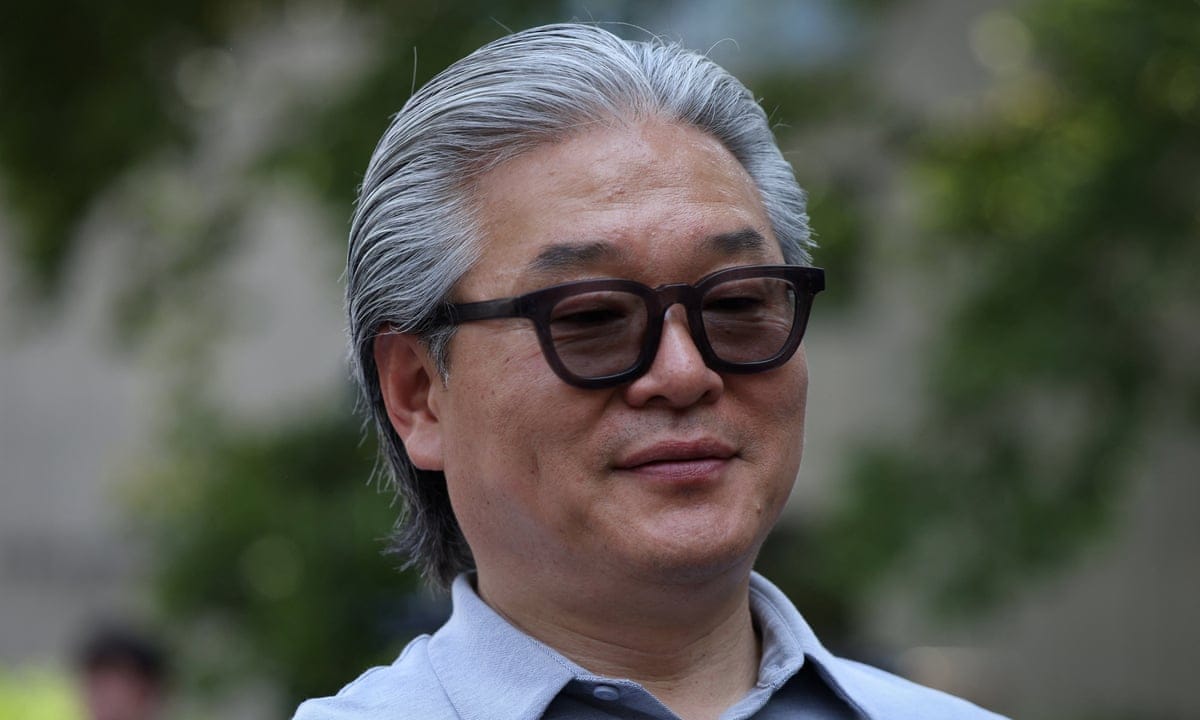

Sung Kook "Bill" Hwang, founder of Archegos Capital Management, was convicted on multiple counts by a Manhattan federal court jury Wednesday. The prosecution accused him of market manipulation leading up to the 2021 downfall of his multibillion-dollar investment firm.

The jury deliberated for several days and found Hwang guilty on nine out of eleven criminal charges, while Patrick Halligan, who served as Archegos' second in command, was convicted on all three counts he faced. As the verdict was announced, both men were accompanied by their legal representatives.

US District Judge Alvin Hellerstein set a sentencing date for October 28th and decided to allow Hwang and Halligan to remain out of custody on bail pending the sentence.

The fallout from Archegos' collapse had global ramifications, drawing regulatory attention across continents. The prosecution argued that Hwang and Halligan deceived financial institutions, obtaining billions in funding by artificially inflating stock values of several public companies they invested in. The trial began earlier this year.

Hwang, aged 60 at the time of his conviction, had denied responsibility for one count related to racketeering and three counts of fraud. He was found not guilty on a market manipulation charge concerning an Asian online entertainment company, iQIYI. Halligan, 47 and serving as Archegos' chief financial officer, faced similar charges but also pleaded innocent to one count related to racketeering conspi CV=0.18

The conviction of Hwang and Halligan is expected to result in imprisonment for the counts they were found guilty on, though any sentence will likely be less severe and determined by the judge based on multiple factors. The trial focused on Archegos' collapse, which led to significant losses at global banks (approximately $10 billion) and investors (over $100 billion in shares).

Prosecutors alleged that Hwang covertly acquired large stakes in numerous companies without actually holding the corresponding stocks. They claimed Hwang misled financial institutions about Archegos' derivative positions, ultimately leading to billions of dollars borrowed and used to inflate stock prices artificially. Halligan was accused of complicity with this fraudulent scheme.

During their respective presentations in court, prosecutors emphasized the extent of the damages caused by Hwang's actions on Wall Street and regular investors alike, while Hwang's defense argued that his trading practices were within legal boundaries. Notable figures involved in Archegos included Tomita, head trader for Archegos, and Scott Becker, chief risk officer - both of whom cooperated with prosecutors by entering guilty pleas on related charges.

According to the US Attorney's Office for the Southern District of New York, Hwang had accumulated positions far exceeding those of companies' largest investors, causing stock prices to rise significantly. At its peak in early 2021, Archegos had assets worth $36 billion and exposure amounting to over $160 billion in equities.

As the markets declined at that time, banks demanded additional collateral from Archegos, which was not available due to their debt structure. Consequently, the banks liquidated stocks backing Hwang's derivative investments, resulting in losses amounting to billions of dollars for various financial institutions and shareholders (including $5.5 billion for Credit Suisse and $2.9 billion for Nomura Holdings).

Read next

Ryanair plane had only six minutes of fuel upon Manchester landing, records show

Flight Narrowly Avoids Disaster After Storm Diversion

An inquiry has been launched after a Ryanair flight, struggling against severe winds during storm Amy last week, landed at Manchester Airport with only six minutes’ worth of fuel remaining.

The aircraft had been transporting passengers from Pisa, Italy, to Prestwick, Scotland, on

"Qantas customer data for 5 million exposed as hackers release info post-ransom deadline"

Hackers Leak Personal Data of 5 Million Qantas Customers on Dark Web

A cybercriminal group has released personal records of 5 million Qantas customers on the dark web after the airline did not meet their ransom demand.

The breach is part of a larger global incident affecting over 40 companies,

Investors flee record-high UK stocks as EU set to hike steel tariffs

Investors Withdraw Record Sums from Equity Funds Amid High Market Valuations

Data reveals that investors in the UK have withdrawn an unprecedented amount of money from equity funds over the past three months, driven by concerns over soaring stock market valuations.

According to the latest figures from Calastone, the largest