Months before Antonio Gracias became involved in scaling back federal operations, he was at Burning Man.

Amid Nevada's dusty landscape, Gracias—a billionaire investor with close ties to Elon Musk—attended Nova Heaven, a sunrise event honoring victims of the October 7 attack. There, he found himself near Rick Doblin, a leading figure in the push for psychedelic drug legalization.

As attendees moved to the rhythm of electronic music, Gracias struck up a conversation, offering Doblin a piece of advice.

Doblin, 71, known for his calm and approachable manner, founded the Multidisciplinary Association for Psychedelic Studies (Maps) and has long advocated for using substances like MDMA in trauma therapy. Once seen primarily as a recreational drug, MDMA has shown promise in medical settings, a view Gracias supports. He donated $1 million to Maps in 2020 and later invested $16 million in psychedelics research at Harvard in 2023. Though his usual style leans more toward boardrooms than dance floors, he represents a growing interest among certain tech and business figures in the potential of mind-altering substances.

Earlier that year, Maps’ pharmaceutical branch, Lykos Therapeutics, had secured $100 million while awaiting FDA approval for MDMA-assisted PTSD therapy. If approved, Lykos stood to become a major pharmaceutical player with exclusive U.S. distribution rights for six years.

But weeks before Burning Man, the FDA rejected the application over insufficient trial data. Doblin left Lykos’s board, and the company cut three-quarters of its staff, leaving it in disarray.

According to Doblin, Gracias told him the FDA’s decision wasn’t his fault and instead pointed to leadership failures. He suggested letting Lykos collapse and rebuilding from scratch before the two parted ways in the desert.

Weeks later, Doblin contacted Gracias with an offer: Lykos’s investors and board weren't willing to let it fail. Would Gracias consider taking over?

As discussions progressed, Doblin connected Gracias with British billionaire Christopher Hohn. By January, just before Gracias joined the government restructuring effort, the two were working on a Lykos takeover.

Late in May, Lykos released a brief update confirming the development.

Read next

"Tesla's European sales drop 40% while BYD registrations surge over threefold"

Tesla Sales Decline in Europe as BYD Gains Ground

Tesla saw a 40% drop in European sales in July compared to the same period last year, as the company faces growing competition from Chinese automaker BYD.

According to data from the European Automobile Manufacturers’ Association (ACEA), 8,837 Tesla vehicles

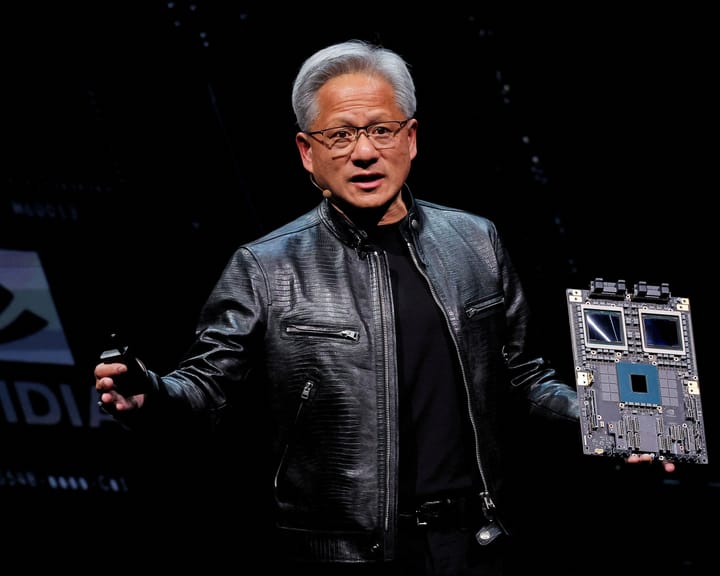

"Nvidia to reveal Q2 earnings amid AI demand surge"

Nvidia to Announce Q2 Results Amid AI Market Uncertainty

Nvidia is preparing to release its second-quarter earnings on Wednesday, marking a key moment for investor sentiment after a recent decline in AI-related stocks.

The chipmaker’s financial performance will be closely watched, given its influence on the broader AI sector

ByteDance to buy back shares at $330 billion valuation

ByteDance Plans New Share Buyback, Valuing Firm at Over $330 Billion

ByteDance, the parent company of short-video platform TikTok, is preparing to introduce a new share buyback program for employees, valuing the Chinese tech firm at more than $330 billion, according to three individuals familiar with the matter. The move