Nvidia to Announce Q2 Results Amid AI Market Uncertainty

Nvidia is preparing to release its second-quarter earnings on Wednesday, marking a key moment for investor sentiment after a recent decline in AI-related stocks.

The chipmaker’s financial performance will be closely watched, given its influence on the broader AI sector following a volatile period. Last week, several tech stocks fell as doubts grew over whether AI-focused companies are overvalued. Concerns were fueled by reports indicating that most AI initiatives fail to boost revenues, as well as comments from OpenAI’s CEO suggesting some firms may be receiving excessive hype.

Nvidia, which recently became the first company to hit a $4 trillion market value, saw its shares drop 3.5% early last week—its sharpest decline in months. However, stocks showed slight recovery by Wednesday morning ahead of the earnings announcement.

Despite the recent turbulence, some analysts remain optimistic about AI’s long-term impact, particularly as major tech firms continue investing heavily in AI-related infrastructure.

“We’re still in the early stages of AI adoption, with more businesses recognizing the potential driven by key industry players,” said Dan Ives of Wedbush Securities, citing Nvidia as one of those leaders.

Wall Street forecasts earnings of $1.01 per share with $46.05 billion in revenue, according to FactSet data. These projections come despite expected financial pressures from restrictions on chip sales to China.

Earlier this year, a ban on AI chip exports to China cost Nvidia $4.5 billion in its first fiscal quarter. In August, the company reached an agreement with U.S. authorities, allowing limited sales of certain chips in exchange for export permits. However, China has expressed security concerns over these chips and is increasing production of its own alternatives. Analysts anticipate the restrictions will affect Nvidia’s earnings to some degree.

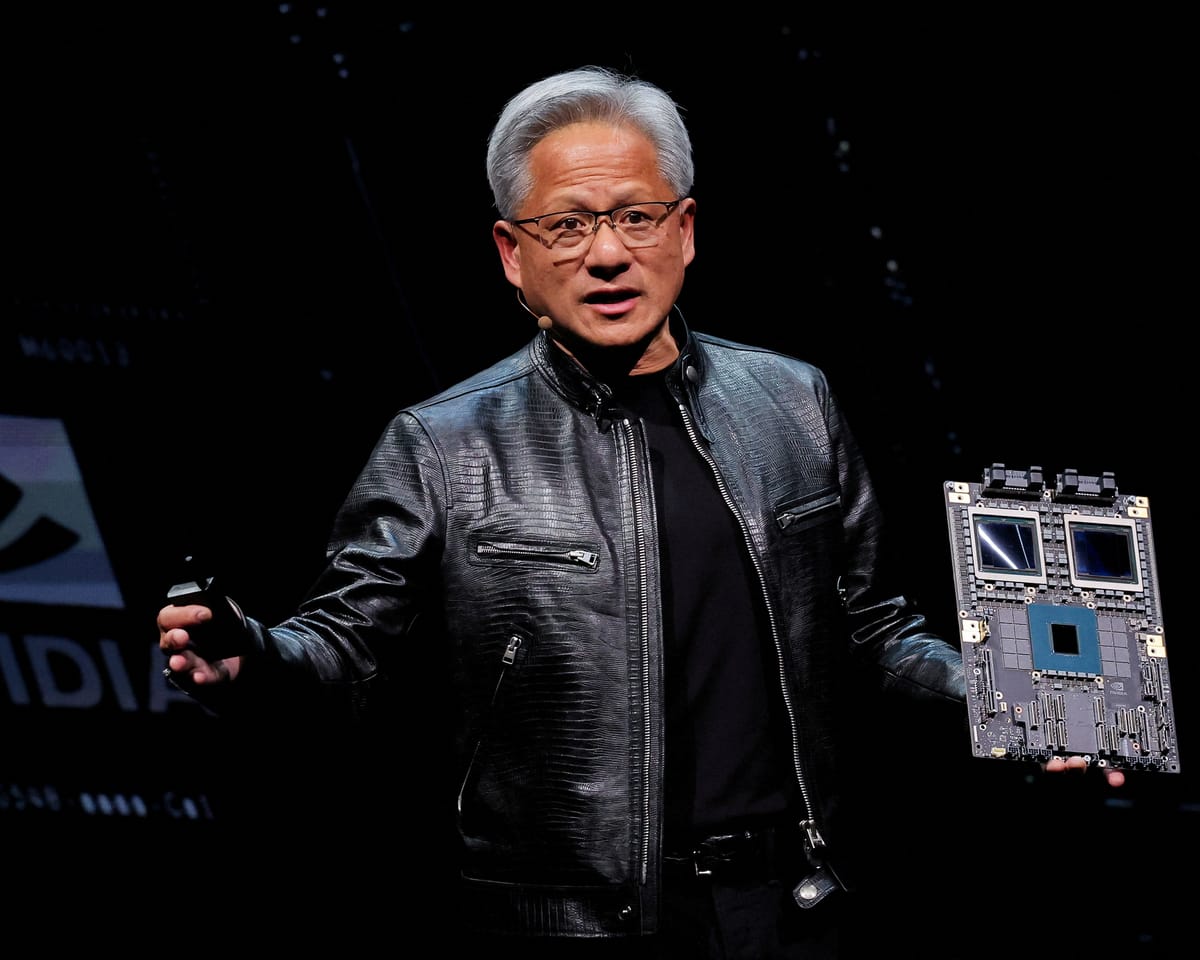

Although CEO Jensen Huang had initially predicted an $8 billion loss in Q2 due to the China ban, the company later secured a deal with the U.S. government. Analysts remain cautiously optimistic about Nvidia’s performance but acknowledge that external factors could influence future growth.

Read next

"Tesla's European sales drop 40% while BYD registrations surge over threefold"

Tesla Sales Decline in Europe as BYD Gains Ground

Tesla saw a 40% drop in European sales in July compared to the same period last year, as the company faces growing competition from Chinese automaker BYD.

According to data from the European Automobile Manufacturers’ Association (ACEA), 8,837 Tesla vehicles

"Musk's Doge ally seizes control of leading US MDMA firm"

Months before Antonio Gracias became involved in scaling back federal operations, he was at Burning Man.

Amid Nevada's dusty landscape, Gracias—a billionaire investor with close ties to Elon Musk—attended Nova Heaven, a sunrise event honoring victims of the October 7 attack. There, he found himself near

ByteDance to buy back shares at $330 billion valuation

ByteDance Plans New Share Buyback, Valuing Firm at Over $330 Billion

ByteDance, the parent company of short-video platform TikTok, is preparing to introduce a new share buyback program for employees, valuing the Chinese tech firm at more than $330 billion, according to three individuals familiar with the matter. The move